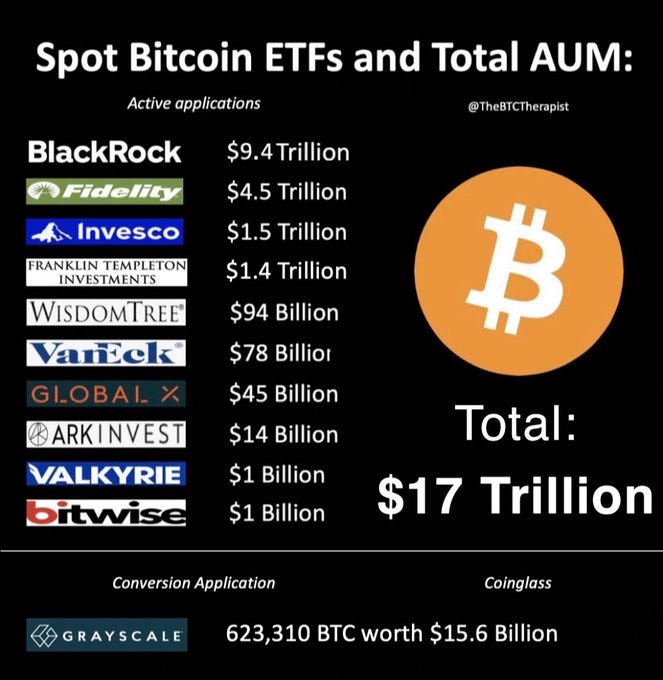

The collective might of over a dozen financial titans, boasting a mind-boggling combined Assets Under Management (AUM) totaling roughly $20 trillion, is poised to revolutionize the Bitcoin industry in 2024. With their colossal financial power and influence, these behemoths are set to inject unprecedented demand into bitcoin’s fixed supply of 21 million bitcoins that’ll ever exist, leading to a skyrocketing bitcoin price as absolute scarcity and unprecedented demand clash. As these financial giants venture into the Bitcoin space, the impact will be monumental, reflecting their massive scale and capacity to shift markets. Sources close to these firms say recent guidance from SEC officials is that a green light will likely come by Jan. 10, 2024. This is the final deadline for the SEC to approve or deny an application from the first firm to ask for the SEC’s blessing for a spot bitcoin ETF

- BlackRock’s Colossal Entry: As the world’s premier asset manager, BlackRock’s entry into the Bitcoin ETF space is nothing short of monumental. With an eye-watering $10 trillion in AUM – a figure that dwarfs many countries’ GDPs – their influence in the financial sector is unparalleled. Managing over 700 ETFs and possessing significant Bitcoin holdings (600K BTC in GBTC), their potential addition of 20K BTC on day one of their Bitcoin ETF launch could send shockwaves through the market. BlackRock boasts a 575-1 record when it comes to its ETF applications.

- Fidelity’s Deep-Rooted Strength: Fidelity, with its 90-year legacy, boasts a formidable $4 trillion in AUM and an even more staggering $10 trillion in Assets Under Administration (AUA). Serving a vast network of 3700 wealth management firms, they are at the forefront of Bitcoin custody solutions. The launch of their Bitcoin ETF, with the potential to mobilize 20K BTC or $1 billion on the first day, stands as a testament to their financial clout and innovative spirit.

- Franklin Templeton’s Quiet Dominance: Franklin Templeton, with over $1.5 trillion in AUM, is a powerhouse in mutual funds, ETFs, and closed-end funds. Their expansive network and lesser-known yet significant presence in the digital asset world position them as a formidable force in shaping the Bitcoin ETF landscape.

- Van Eck and Wisdom Tree’s Strategic Focus: Commanding significant assets of $80 billion and $72 billion respectively, Van Eck and Wisdom Tree may not rival BlackRock or Fidelity in size, but their strategic focus on bitcoin places them ahead of many traditional digital asset firms. Their investment in bitcoin highlights a forward-thinking approach, aligning with the latest trends in financial technology.

- Digital Asset Innovators: Firms like NYDIG, Galaxy, ARK, Bitwise, and Valkyrie, with their AUMs ranging from $1 billion to $11 billion, are deeply entrenched in the digital asset space. Their involvement in the Bitcoin ETF market underscores their expertise and readiness to capitalize on the burgeoning demand for digital currencies.

- Emerging Giants: Hashdex and Pando: Making significant strides in South America and Switzerland, Hashdex and Pando are emblematic of the rising global interest in Bitcoin ETFs. Their emergence on the financial stage reflects a shift towards a more inclusive and diverse digital asset investment landscape.

- Future Expansion: The potential entry of industry juggernauts like Vanguard and Charles Schwab into the Bitcoin ETF market hints at an impending surge in institutional adoption. Their participation could further amplify the market’s capacity, drawing in more investors and solidifying bitcoin’s position in the financial sector.

Bitcoin’s Real Estate Renaissance: The influx of capital from these financial titans into bitcoin is not just a market trend; it’s a paradigm shift. Real estate professionals, recognizing this seismic change, must align with innovative leaders like Orange Bridge, who are integrating bitcoin into the real estate sector, heralding a new era of transactional efficiency and asset diversification.

A Call to Action: As bitcoin becomes more mainstream, driven by these financial giants, it’s crucial for real estate professionals to stay informed. Orange Bridge is at the forefront of integrating bitcoin into the real estate sector.

Visit OrangeBridge.com to learn how this integration is shaping the industry and why understanding bitcoin is essential for addressing client inquiries in this evolving landscape.