Diversify Home Equity Into Bitcoin

Orange Bridge’s exclusive 'Co-Invest' offering allows homeowners to simply and seamlessly diversify a portion of their home equity into bitcoin.

Introducing Co-Invest

Unlocking Home Equity for Bitcoin Investment

A large portion of Americans’ net worth is tied up in their home equity, which often remains dormant until they sell their home or tap into it through traditional options such as a cash-out refinance or HELOC. Rather than allowing home equity to remain latent and over-allocated, Orange Bridge has developed a strategy for homeowners to unlock a prudent portion of their home equity and convert it into bitcoin, without taking on additional monthly debt servicing payments.

The four-step Orange Bridge ‘Co-Invest‘ process was created to help homeowners enhance their investment returns and diversify their portfolios by accessing their home equity via an entirely new 2nd lien mortgage product. This process enables homeowners to add bitcoin to their holdings for further wealth diversification.

At the conclusion of the loan term, homeowners can pay off their loan via proceeds from the sale or refinancing of the subject property, or from the proceeds of a partial sale of the bitcoin (or cash on hand). If bitcoin appreciates at a greater rate than homes appreciate, homeowners may find themselves in a substantially better position than had they decided not to participate in our ‘Co-Invest’ process.

Learn more about diversifying latent home equity into bitcoin!

FAQ Overview for Orange Bridge Co-Invest

What is Orange Bridge Co-Invest?

Orange Bridge’s four-step ‘Co-Invest’ process allows homeowners to diversify a prudent portion of their home equity into bitcoin without incurring monthly debt payments. A large majority of homeowner’s net worth is locked up in latent home equity; Orange Bridge Co-Invest allows homeowners to rebalance their net worth with low risk by converting a prudent amount to bitcoin.

Who is Orange Bridge?

Orange Bridge is a nexus between the established realms of real estate, finance, and the innovative world of Bitcoin. Drawing from a collective 75 years of Real Estate and Residential Lending experience, our ambition is straightforward: to lead the fusion of traditional real estate with the emerging Bitcoin domain. As these sectors converge, Orange Bridge is dedicated to arming professionals, homeowners, and enterprises with the insights and resources to leverage the promise of this revolutionary technology.

What does the Co-Invest process entail?

Co-Invest is a revolutionary four-step process that allows homeowners to unlock a prudent portion of their home equity and seamlessly convert it into bitcoin without incurring monthly payments during the agreement term.

Step 1: Equity Diversification

We introduce you to an innovative financing product that doesn’t require monthly payments in exchange for sharing a portion of future home value appreciation. We will work alongside you throughout the financing process to generate the proceeds for your bitcoin purchase.

Step 2: Bitcoin Purchase

Once your proceeds are available, we will provide guidance as you purchase bitcoin and transfer it to your new multi-signature custodial wallet.

Step 3: Multi-Sig Cold Storage Setup

We assist you in setting up a secure multi-signature cold storage wallet to ensure the safety and security of your bitcoin. This setup adds an extra layer of protection, making it highly resistant to unauthorized access and theft.

Step 4: Disposition Guidance

We will assist you in navigating the loan payoff process when you decide to pay your loan in full. While you will primarily work with the Capital Partner who provides the mortgage loan, our dedicated team is here to assist as needed.

Additionally, we will assist with closing out all aspects of the Orange Bridge Co-Invest™ Master Agreement, pertaining to the disposition and exit of your bitcoin position. If you choose to move your bitcoin to another wallet option outside of the multi-signature structure used during the agreement, we will provide the necessary support to facilitate this transition.

What are the features and benefits of the loan product used for bitcoin purchase?

The loan product used in the Orange Bridge Co-Invest process offers several attractive features and benefits:

No Monthly Payments: Loan repayment can be made at the conclusion of the agreement using proceeds from the sale or refinancing of the home, or from bitcoin sale proceeds (or cash on hand).

No Prepayment Penalty: You can repay the loan early without any additional fees.

Balloon Payment at Maturity: The full repayment of the loan is due at the end of the term.

How Does It Work?

With a typical mortgage, you must make monthly out-of-pocket payments. However, leveraging the four-step Co-Invest process, clients incur no monthly payments during the loan term. Instead, loan repayment can be made at the conclusion of the agreement using proceeds from the sale or refinancing of the home, or from bitcoin sale proceeds (or cash on hand).

How do I know if I qualify?

Confirming your home equity position via standard appraisal report is a key factor for eligibility, as well as Credit, Assets, & Income verifications which are required per regulatory guidelines.

Orange Bridge seeks to partner with responsible homeowners, who meet the following requirements:

Financially Savvy: Understand the benefit of diversifying home equity into bitcoin

Strong Credit Score

Ample Income/Assets

Ample Home Equity

Primary Residence

Low Time Preference

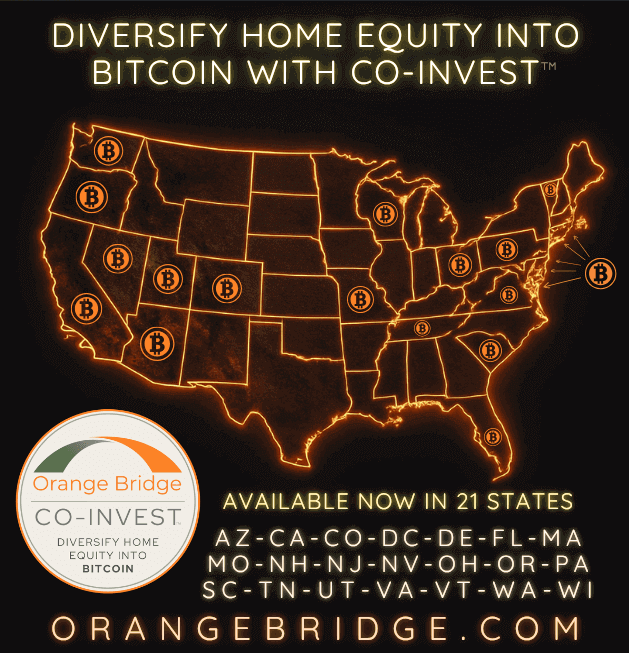

Where is Co-Invest available?

Co-Invest is Available in: AZ, CA, CO, DC, FL, MA, MO, NJ, OH, OR, PA, SC, TN, UT, WA, WI

How can I establish a bitcoin position quickly with Co-Invest?

Orange Bridge Co-Invest offers a streamlined process to quickly diversify home equity into a bitcoin investment, avoiding unnecessary costs, and potential price appreciation delays associated with traditional loan options.

How does the financing component of the Co-Invest process differ from traditional Home Equity Loans or HELOCs?

NO monthly payments required! You can keep the low rate on your current first mortgage and don’t have to make monthly payments, giving you extra money for other needs.

How does the financing component of the Co-Invest process differ from other Home Equity Share (HES) products?

The loan product offered by our Capital Partner provides homeowners greater safeguards and potentially lower costs than other equity sharing agreements. Like all other mortgage products, it is regulated and can only be originated by a licensed loan officer making it more predictable, secure, and controlled to protect all parties involved (the borrower, broker and lender).

Annual percentage rate thresholds set a capped amount of what you owe, unlike other products that may present unknown risks as their balance accrues.

What are the exit terms associated with Co-Invest?

Exit any time with no Prepayment Penalty

What happens at the end of the Co-Invest term?

At the conclusion of the loan term, homeowners can pay off their loan via proceeds from the sale or refinancing of the subject property, or from the proceeds of a partial sale of the bitcoin (or cash on hand). If bitcoin appreciates at a greater rate than homes appreciate, homeowners may find themselves in a substantially better position than had they decided not to participate in our ‘Co-Invest’ process.

How does Co-Invest contribute to long-term portfolio growth for homeowners?

It offers a streamlined process to diversify home equity into a bitcoin investment, providing homeowners with a diversified strategy for long-term portfolio growth.

What’s the benefit of diversifying latent home equity into bitcoin?

Consider diversifying your latent home equity into bitcoin, given its incredible value growth and strong future potential due to its limited supply and rising demand. Since bitcoin is viewed as a commodity and property by the US government, it can be a smart addition to your portfolio. This way, you can include digital property that is incorruptible and creates an easy inheritance vehicle for future generations.

What if I'm skeptical about bitcoin's value or haven't owned any?

Bitcoin, like any currency, has value based on durability, portability, divisibility, fungibility, scarcity, and acceptability. We believe bitcoin surpasses other forms of money in these characteristics.

Why is early adoption of bitcoin crucial for homeowners?

Bitcoin is set to redefine the real estate industry. Early awareness and adoption ensures you’re ahead of the curve, to utilize game-changing diversification products like Co-Invest.