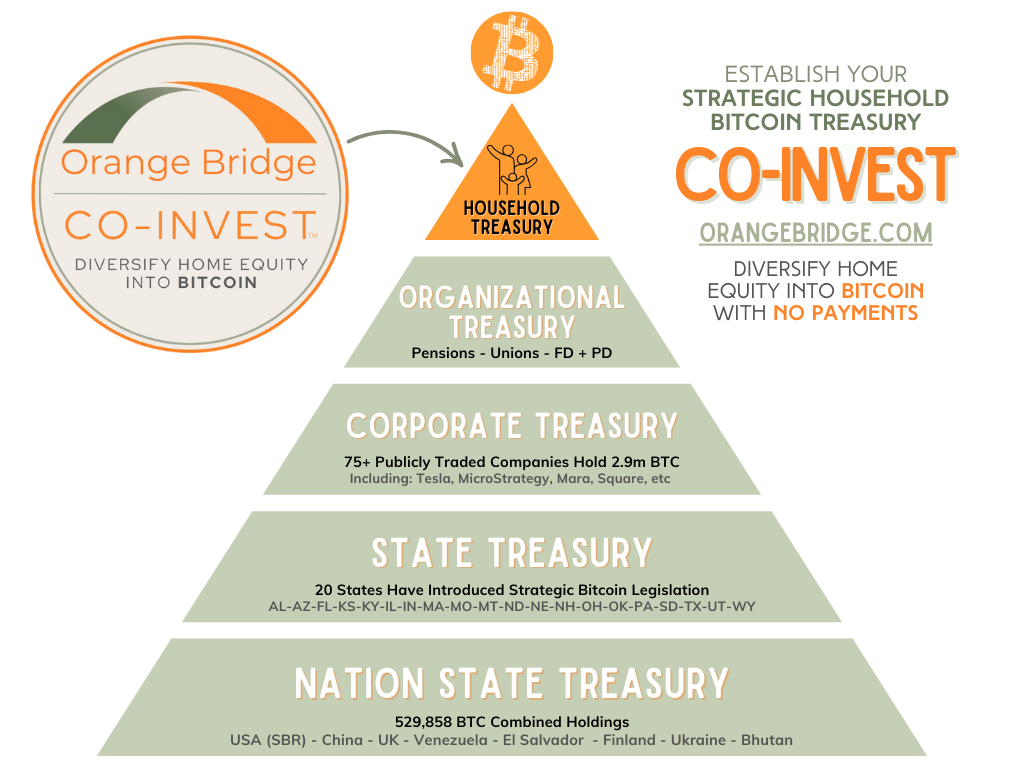

In the ever-evolving world of finance, where digital currencies like Bitcoin are no longer just for tech enthusiasts but are becoming serious considerations for nation-states, corporations, and now, individual households, there’s a new player in town: Co-Invest by OrangeBridge.com. This product isn’t just about investing; it’s about strategically building what I call a “Strategic Household Bitcoin Treasury.”

The Concept of a Strategic Household Bitcoin Treasury

Imagine for a moment that your home isn’t just where you live; it’s also a cornerstone of your financial strategy. Just as countries like El Salvador have embraced Bitcoin or corporations like MicroStrategy have added it to their treasury reserves, why can’t the average homeowner do the same?

Co-Invest allows homeowners to leverage their home equity not just for traditional purposes but to diversify into Bitcoin, potentially one of the most revolutionary assets since the advent of the internet.

Why Bitcoin for Your Household?

- Diversification: By converting part of your home equity into Bitcoin, you’re not putting all your eggs in one basket. You’re spreading risk across different asset classes.

- Inflation Hedge: With central banks printing money at unprecedented rates, Bitcoin’s fixed supply (only 21 million coins will ever exist) makes it an attractive shield against inflation.

- Long-Term Growth: Bitcoin has historically outperformed many traditional investments over the long term, despite its volatility.

- Global Trend: From U.S. states like Texas and Oklahoma to pension funds, there’s a growing trend of integrating Bitcoin into reserves. Why miss out on this global shift in financial strategy?

How Co-Invest Works

With Co-Invest, homeowners can unlock a portion of their home’s equity and invest it into Bitcoin without the immediate pressure of monthly payments. Here’s how:

- 10-Year Loan Term: You have a decade to pay back the loan, aligning with Bitcoin’s long-term growth cycles rather than short-term market noise.

- No Monthly Payments: This frees up cash flow for other investments or emergencies, all while your Bitcoin might grow.

- 3x Automatic Trigger: If Bitcoin triples in value, the system automatically closes your investment, ensuring you can pay back the loan plus interest, potentially leaving you with profit.

This setup mirrors the strategic reserve approach taken by larger entities but scaled to the household level.

The Upside of Bitcoin in Your Home Treasury

- Historical Performance: Bitcoin has repeatedly shown significant returns, with past cycles suggesting that hitting a 3x return within a decade is not just possible but historically probable.

- Decentralization and Scarcity: Unlike real estate or stocks, Bitcoin’s supply is strictly limited, potentially driving up value as demand grows.

- Global Acceptance: As more institutions and countries recognize Bitcoin, its legitimacy and value could further increase.

- Leverage Effect: Investing in Bitcoin with home equity amplifies potential gains, much like how nations or corporations leverage their assets for strategic gains.

Homeowners Hold the Same Power as Countries and Corporations

The concept of a household Bitcoin treasury through Co-Invest is not just about making money; it’s about aligning personal finances with global economic trends. It’s about innovation in how we perceive and manage our wealth. As we see more entities from governments to corporate giants treating Bitcoin with strategic importance, why shouldn’t the individual homeowner do the same?

By leveraging home equity in this unique way, you’re not just investing; you’re participating in a financial revolution, securing your financial future in a world where digital assets are becoming as fundamental as traditional ones.

So, if you’re a homeowner with an eye on the future, perhaps it’s time to consider how a portion of your home’s equity could serve not just your living needs but also your financial legacy through a strategic Bitcoin treasury.